Insurance policy service providers wish to see shown liable behavior, which is why web traffic accidents as well as citations are elements in establishing vehicle insurance policy rates - credit. Aims on your certificate don't stay there for life, yet just how long they remain on your driving record varies depending on the state you live in and also the extent of the infraction.

As an example, a new sports auto will likely be more pricey than, say, a five-year-old car (cheaper auto insurance). If you pick a reduced deductible, it will result in a greater insurance coverage expense that makes picking a greater deductible feel like a respectable offer. Nonetheless, a greater insurance deductible might mean paying more expense in case of a mishap.

What is the typical vehicle insurance coverage expense? There are a wide range of variables that affect just how much automobile insurance policy expenses, that makes it challenging to get a precise suggestion of what the typical individual pays for auto insurance policy. According to the American Car Organization (AAA), the typical price to insure a sedan in 2016 was $1222 a year, or about $102 per month.

cheaper auto insurance cheaper cheap auto insurance cheaper

cheaper auto insurance cheaper cheap auto insurance cheaper

Just how do I obtain cars and truck insurance policy? Obtaining a cars Find out more and truck insurance estimate from Nationwide has never ever been easier.

Your own costs may vary. The quickest means to discover out how much a vehicle insurance coverage policy would cost you is to use a quote calculator device.

The smart Trick of Auto Insurance Climbing 5% In 2022. Where It's Most, Least ... That Nobody is Discussing

Different states additionally have various driving problems, which can affect the cost of automobile insurance policy. To provide you some suggestion of what vehicle drivers in each state spend yearly on automobile insurance, the table listed below shows the typical price of car insurance by state, according to the 2021 NAIC Automobile Insurance Coverage Database Report.

Bundling: Packing your home and also car insurance coverage plans normally causes costs price cuts - vehicle insurance. You can likewise conserve money for insuring several lorries under the exact same plan. Paying in advance: Many insurance providers supply a pay-in-full discount rate. If you have the ability to pay your whole premium simultaneously, it's frequently a much more economical option.

Our method Since customers count on us to provide unbiased as well as accurate details, we developed a thorough score system to develop our positions of the very best car insurer. We accumulated data on loads of automobile insurance policy suppliers to grade the firms on a wide variety of ranking variables. Completion outcome was an overall rating for each and every supplier, with the insurance firms that scored the most factors topping the checklist.

Schedule: Car insurance companies with higher state accessibility and few eligibility requirements racked up greatest in this group. Insurance coverage: Firms that offer a variety of choices for insurance coverage are extra most likely to fulfill customer needs. Cost: Ordinary car insurance coverage prices and price cut chances were both taken right into factor to consider.

The 8-Minute Rule for How Much Is Car Insurance? - Nationwide

Typical Automobile Insurance Coverage Prices by Coverage Degree When it pertains to safeguarding your vehicle, we recognize that everybody's demands are different - cheapest auto insurance. That's why we offer numerous kinds of auto insurance policy coverage. Having full insurance coverage aids you remain risk-free on the roadway. This is additionally among the reasons that the average cost of car insurance ranges consumers.

car cheaper cheaper car

car cheaper cheaper car

A policy that will certainly pay for home damages up to $50,000 will certainly have a higher premium than one that just pays for repair work up to $25,000. Ordinary Vehicle Insurance Policy Rates by Age Your auto insurance coverage rates will likewise differ based on your age team.

Ordinary Car Insurance Coverage Prices by State The average auto insurance policy price by state varies. According to the Insurance Coverage Info Institute (III), Iowa has some of the most inexpensive vehicle insurance coverage in the nation at $674, while Louisiana had some of the most costly at $1,443.

At What Age Is Vehicle Insurance Cheapest? 5 That means as a vehicle driver obtains older and also gains even more experience on the road, their rates will likely reduce.

Which Age Team Pays the Many for Car Insurance? Insurance companies normally charge a lot more for vehicle drivers that are under the age of 25. Because 1984, The Hartford has aided virtually 40 million AARP participants obtain the auto protection they need through unique benefits as well as discount rates What State Has the Most affordable average auto insurance rates?

What Does Cost Of Auto Insurance - Rocky Mountain Insurance ... Do?

They'll aid you get the automobile policies you require, whether it's to help spend for damages after an accident or to protect you from collisions with without insurance drivers. business insurance.

In enhancement to the insurance policy firm you choose, aspects such as your age, vehicle make and model, as well as driving history can affect your premium, so what's finest for your next-door neighbor could not be best for you. How Much Does Vehicle Insurance Coverage Expense?

Before we delve the factors that can influence a premium, let's check out some typical repayments simply based upon reduced or high levels of protection. Usually, getting the minimal liability insurance coverage is cheaper than a complete insurance coverage plan. However, it may be best to spend for even more coverage as opposed to pay for high repair expenses down the line.

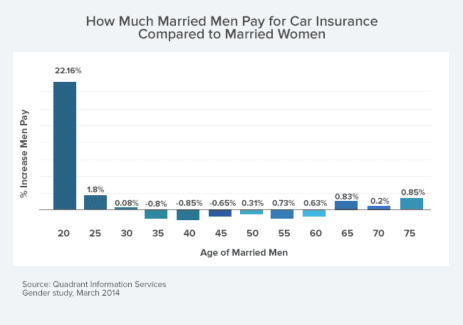

Young males generally get higher quotes than young females because research studies by the Insurance Institute for Highway Security show more young men finish up in crashes - insured car. In the exact same means, a research study by the Customer Federation of America discovered that older ladies collapse a lot more commonly than older guys, indicating that average car insurance settlements for older women can be a little greater.

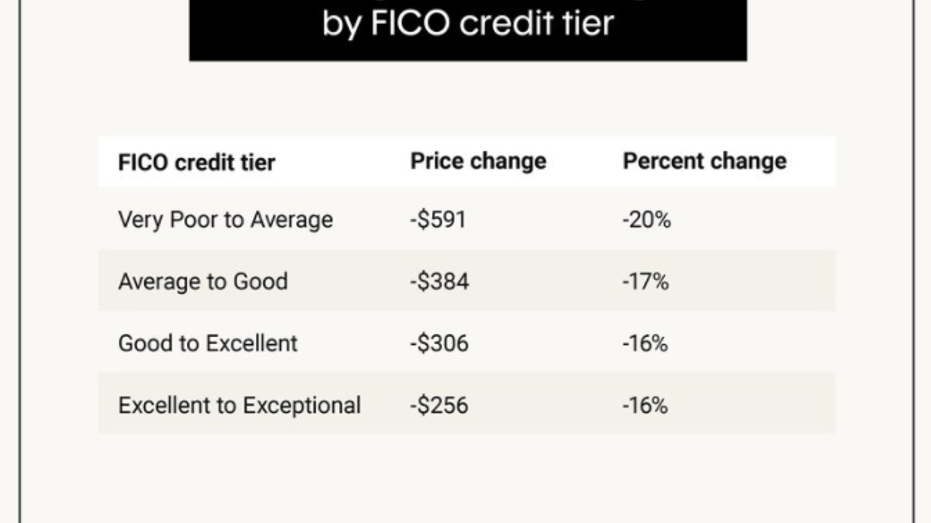

Most insurer take your credit report into consideration when establishing just how much you will certainly pay for vehicle insurance. In basic, vehicle drivers with bad debt pay more compared to those with great credit report. Vehicle insurance policy business in some cases adjust rates according to your job. For instance, distribution motorists as well as reporters invest even more time when traveling, so these vehicle drivers are more probable to be in an accident.

The 6-Minute Rule for See The Average Auto Insurance Rate For Your Michigan Zip Code

New automobiles cost even more to replace in case of an overall loss, so collision insurance coverage is much more costly. Every car on the market experiences the safety rating process. Autos with high safety and security scores provide a reduced opportunity of serious injuries, indicating your insurance provider will have fewer medical bills to pay (low cost auto).

Your insurance deductible can likewise affect just how much your auto insurance policy premium costs. Exactly How Much Is Automobile Insurance Policy For Various Ages And Genders?

These departments also determine how insurer examine risk and establish ordinary automobile insurance coverage prices for state citizens. Keeping that being stated, the majority of states need that all drivers carry particular quantities of obligation auto insurance coverage. Several states run a no-fault system, implying chauffeurs' insurance coverage companies are accountable for any type of injuries as well as property damage no matter fault, so that affects required insurance coverage as well. low cost.

As a result of this, rates vary drastically from individual to individual (cheaper cars). This is why we suggest obtaining quotes from a number of insurance coverage business. The device listed below can aid with that. Keeping that being claimed, several of the above-listed companies offer affordable prices. We lately researched the ideal cars and truck insurance coverage firms in the nation.

As you can see from the data, USAA car insurance has a few of the most affordable ordinary prices in the market without a doubt. This, along with its terrific client service, makes it one of our leading options for automobile insurance. USAA is only available to current as well as former army as well as their household participants.

Facts + Statistics: Auto Insurance - Iii Things To Know Before You Get This

Methodology In an effort to provide exact as well as impartial info to consumers, our professional evaluation team gathers data from loads of automobile insurance service providers to create rankings of the most effective insurers. Business get a score in each of the complying with categories, along with a total heavy score out of 5. insurance affordable.

Among the greatest aspects for clients seeking to acquire cars and truck insurance is the rate. Not just do rates vary from business to firm, but insurance policy expenses from state to state differ. According to , the ordinary annual price of auto insurance coverage in the United States was $1,633 in 2021 and also is predicted to be $1,706 in 2022 (insurance companies).

Typical rates differ commonly from one state to another (cheaper car insurance). Insurance coverage rates are based on multiple requirements, including age, driving history, credit rating, the amount of miles you drive annually, automobile type, and also a lot more. Depending on typical auto insurance policy costs to estimate your cars and truck insurance premium might not be one of the most accurate way to figure out what you'll pay.

Insurance providers use several aspects to figure out prices, as well as you might pay essentially than the ordinary vehicle driver for coverage based on your risk profile. As an example, more youthful vehicle drivers are generally extra most likely to enter into a mishap, so their costs are usually greater than standard. You'll also pay more if you have an at-fault crash, multiple speeding tickets, or a DUI on your driving document - car insurance.

It may not provide adequate security if you're in an accident or your car is harmed by an additional covered case. Interested about how the average rate for minimum insurance coverage piles up versus the cost of full protection?

The Facts About How Much Is Car Insurance? These Are The Average Costs Revealed

cheaper money cheaper insured car

cheaper money cheaper insured car

The only means to recognize exactly just how much you'll pay is to shop about and get quotes from insurance companies. One of the aspects insurers use to identify prices is area. Individuals that reside in locations with greater theft prices, mishaps, and natural disasters normally pay more for insurance. And because insurance policy regulations as well as minimum protection requirements differ from one state to another, states with higher minimum needs typically have higher ordinary insurance expenses.

The majority of but not all states permit insurance provider to use credit history when establishing prices. Generally, applicants with lower scores are most likely to sue, so they generally pay a lot more for insurance than vehicle drivers with higher credit rating. If your driving record includes crashes, speeding up tickets, Drunk drivings, or other infractions, anticipate to pay a higher premium.