If you determine to bring just responsibility coverage, which secures you in the event that you wound somebody or their home with your lorry and they sue you, after that a deductible won't use (car insurance). If you're carrying both comprehensive and crash protection, you'll require to select one insurance deductible for each, and they can be various quantities.

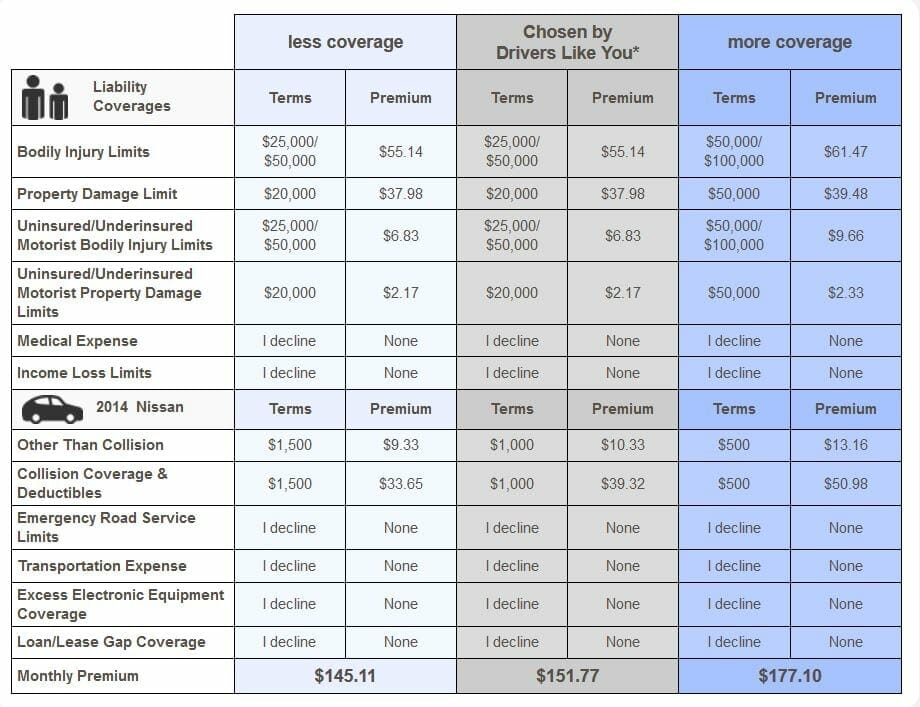

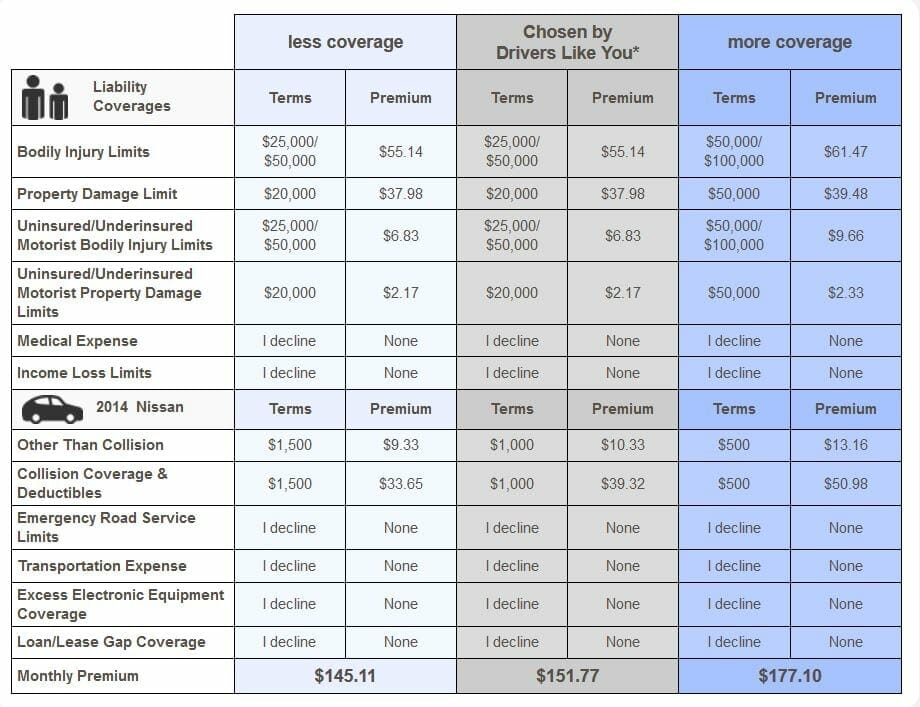

Yet that indicates you require to offer severe factor to consider to what you might deal with economically if you had to pay your deductible for either thorough or accident coverage. Is $500 all you can manage to cover? Or is $1,000 manageable? What about $2,000? When you're comparing auto insurance coverage prices, experiment with the deductible amount as well as see what it does to your costs (cars).

Whether you're a brand-new motorist or have actually been behind the wheel for several years, it can be daunting to wade through insurance coverage terminology like "deductible - cheap car." Your car insurance deductible affects the price of your insurance policy, so it is necessary that you select one very carefully. The insurance deductible that's right for you depends on your specific conditions.

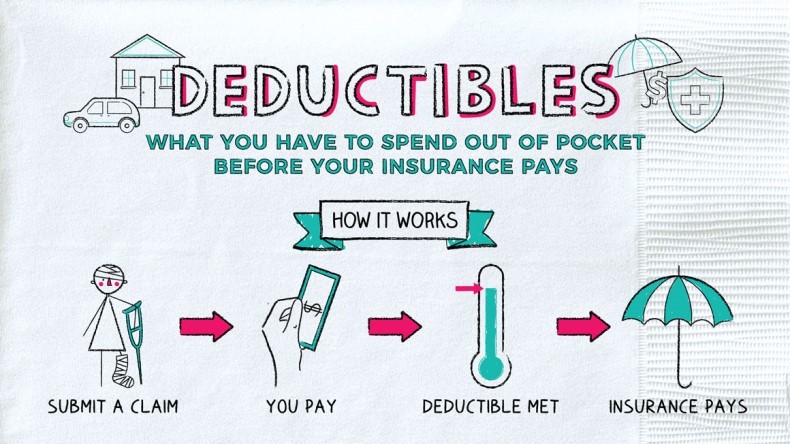

If you need to file a claim with your automobile insurance policy service provider after an accident, or when your auto is otherwise damaged, there's a likelihood you'll need to pay an insurance deductible. How does a deductible job? A deductible is the quantity of money you pay out of pocket prior to your insurance protection begins as well as begins spending for the costs of your loss.

Not all insurance protections need a deductible, but if your own does, you'll select the quantity. accident. Your insurance deductible will influence your monthly insurance coverage settlement the lower your deductible, the greater your auto insurance policy premium.

Not known Factual Statements About What You Need To Know About Your Car Insurance Deductible

Auto insurance policy plans can consist of various sorts of coverage that offer varying purposes, and you can select to be covered by some or all of them. Several of these insurance coverage choices require deductibles and some do not, so it deserves noting what deductibles you'll be called for to pay. State law generally figures out whether a deductible is called for.

This covers you if your automobile hits an additional lorry or object as well as you need to pay for repair work. Accident deductibles are standard but differ by insurer. If your lorry is damaged by an event such as fire, a dropping things striking your windshield or criminal damage, you'll file a comprehensive insurance coverage insurance coverage case.

If the various other vehicle driver in an accident is at mistake however they aren't insured or don't have sufficient protection to pay for your building damage, this kind of insurance coverage will come to the rescue. Deductibles are in some cases needed for this insurance coverage, however not always, and also demands vary by state. While your auto insurance coverage deductible can vary substantially depending upon lots of factors, including just how much you want to pay, cars and truck insurance policy deductibles normally range from $100 to $2,500.

When selecting an insurance deductible, you'll need to take into consideration several aspects, including your budget. Invest time calculating just how much you can manage to spend for an insurance deductible and just how much you'll save money on your regular monthly costs by selecting a greater one. Ask yourself these questions when picking a deductible amount.

If you get in an accident, can you manage the deductible or would you battle to pay it? Taking on a high deductible may not make much feeling if it represents a big portion of the automobile's worth.

How Car Insurance Works - Usnews.com Can Be Fun For Everyone

Maintaining car insurance coverage is one task, yet suing and handling the expense of repairs from an at-fault accident is another - business insurance. Yet what takes place if you can not pay your vehicle insurance deductible? Continue reading to learn more about vehicle insurance coverage deductibles and also exactly how you can develop your plan to fit your needs as well as budget, even after entering an accident.

We recommend getting several quotes to find the ideal rates and deductibles. Enter your zip code to get begun or call our group at.: What Is An Auto Insurance Deductible?

If you have a $500 deductible, you need to pay that quantity before the insurer covers the staying $1,500. car insured. Nevertheless, if you have a $500 insurance deductible but your cars and truck repair service costs are just $400, that implies you'll have to pay the sum total of repairs without the auto insurer's aid.

Secures your automobile against damage from points aside from an accident, like fire, burglary, criminal damage, severe weather, and also animals. Since it tends to have lower costs, you might escape picking a reduced deductible - liability. Spends for damages to your car that were the outcome of an accident with an additional car.

Accident security and also uninsured/underinsured vehicle driver protection may also have deductibles. Talk with an insurance policy agent to discover just how to select your deductible and car insurance coverage costs prices for these insurance coverages based upon your state's rates. What Occurs If You Can Not Pay Your Deductible? When paying an insurance policy claim, your insurer will frequently create you a check for the amount it's responsible for covering. vans.

Everything about How To Make Choosing The Right Car Insurance Deductible ...

Below are some steps you can take if you can not afford to pay your deductible: Maybe rewarding to talk with your mechanic concerning settlement alternatives after an accident. You could be able to work out with the auto mechanic to waive your insurance deductible or for a payment plan. If you make a decision to take your vehicle insurance coverage check to another service center, it could mean less expensive repairs - cars.

Waiting to sue is not unusual, but it is suggested to submit a case as rapidly as feasible. cheap. When an automobile insurance policy fixing is urgent, getting a finance may be the most effective alternative. It will likely obtain you, your automobile, and various other events entailed back when traveling faster.

auto insurance laws auto insurance affordable

auto insurance laws auto insurance affordable

If you just do not have the funds for the complete repair services, attempt beginning with the most important or necessary repair work, after that function on the rest in time as you have the funds to cover them. The amount of time you have to pay your deductible depends upon the repair service shop you pick.

Will Deductibles Impact Your Premium? Prior to you pick your insurance deductible, put in the time to completely understand exactly how standard cars and truck insurance policy works. Getting the full picture can help you become extra certain when driving. Your auto insurance deductible is exactly how you share the duty to cover losses with your insurance coverage company.

This forces you to cover your deductible. If you are not responsible in a crash and also one more chauffeur strikes you, you may not have to pay your deductible. The at-fault driver's obligation coverage must cover the cost of damages. cheaper auto insurance. It's not suitable to try to get out of paying a vehicle insurance policy deductible.

Some Known Factual Statements About Who Pays For My Deductible After A Car Accident? - The ...

Enter your zip code or phone call to obtain vehicle insurance coverage prices quote from companies in your location: Geico is just one of the biggest insurance companies in the nation with a solid economic support and the goal to save chauffeurs the most amount of cash. It offers affordable vehicle insurance prices for its 6 typical insurance policy protection options (cheaper cars).

There are many readily available discounts, including those for safety and security functions on your automobile, going paperless, as well as paying your premium in full. Progressive has an easy quote process, which enables you to contrast other vehicle insurance companies right on its web site (cheapest car insurance).

Deductible specified A deductible is an amount of cash that you yourself are accountable for paying toward an insured loss. When a catastrophe strikes your residence or you have a car mishap, the quantity of the insurance deductible is deducted, or "deducted," from your insurance claim repayment. Deductibles are the way in which a risk is shared between you, the insurance policy holder, and your insurance firm. insure.

cheapest car insurance affordable cheapest vans

cheapest car insurance affordable cheapest vans

A deductible can be either a specific buck quantity or a percent of the total quantity of insurance on a policy. The amount is developed by the regards to your insurance coverage and also can be located on the affirmations (or front) page of conventional homeowners and automobile insurance coverage. State insurance coverage policies strictly determine the way deductibles are included into the language of a plan as well as just how deductibles are executed, as well as these laws can differ from state to state.

In case of the $10,000 insurance loss, you would certainly be paid $8,000. In case of a $25,000 loss, your claim check would be $23,000. Keep in mind that with auto insurance policy or a home owners plan, the insurance deductible applies each time you file a case. The one major exception to this remains in Florida, where cyclone deductibles especially are applied per season as opposed to for each storm.

10 Simple Techniques For What Is A Deductible In Car Insurance? - Fox Business

affordable auto insurance car insured accident cheaper

affordable auto insurance car insured accident cheaper

To utilize a a house owners policy instance, a deductible would relate to home damaged in a rogue exterior grill fire, but there would certainly be no deductible versus the obligation section of the plan if a burned visitor made a clinical claim or sued. Raising your insurance deductible can conserve money One means to conserve money on a home owners or car insurance plan is to increase the insurance deductible so, if you're purchasing insurance policy, ask regarding the alternatives for deductibles when comparing plans.

Going to a $1,000 insurance deductible might conserve you also extra. Many property owners and renters insurers provide a minimal $500 or $1,000 insurance deductible.

In some states, policyholders have the alternative of paying a greater costs in return for a conventional dollar deductible; however, in high-risk seaside locations insurance providers may make the portion deductible obligatory. work in a comparable means to typhoon deductibles and also are most typical in position that generally experience serious cyclones and also hail storm.

Wind/hail deductibles are most commonly paid in percentages, typically from one to 5 percent. If you haveor are taking into consideration buyingflood insurance, make certain you comprehend your insurance deductible. Flood insurance deductibles differ by state as well as insurance provider, and are readily available in buck quantities or percentages. In addition, you can select one deductible for your home's structure and another for its contents (note that your mortgage business may require that your flood insurance coverage deductible be under a particular amount, to assist ensure you'll be able to pay it).

Insurers in states that have more than ordinary threat of earthquakes (for instance, Washington, Nevada and also Utah), frequently set minimum deductibles at around 10 percent. In The golden state, the basic California Earthquake Authority (CEA) plan consists of an insurance deductible that is 15 percent of the substitute expense of the main home framework and also beginning at 10 percent for added protections (such as on a garage or various other outhouses) (insurance company).

How Car Insurance Deductible Guide: How Does It Work In 2022? https://car-insurance-bridgeview-illinois.s3.ap-northeast-2.amazonaws.com/index.html can Save You Time, Stress, and Money.

Discover what an automobile insurance deductible is and also exactly how it affects your automobile insurance coverage. Cars and truck insurance policy all of us know we need it. Past that, several of us still ask ourselves, "What vehicle insurance coverage should I obtain?" The secret is knowing what deductibles as well as insurance coverages are as well as how they impact auto insurance coverage.

What is an insurance deductible? Place simply, an insurance deductible is the amount that you agree to compensate front when you make an insurance policy claim, while the insurance coverage business pays the remainder approximately your protection restriction. When choosing your car insurance deductible, consider just how much you agree to pay of pocket if you need to make an insurance claim.

insurance affordable money cheaper car money

insurance affordable money cheaper car money

It actually comes down to what makes you one of the most comfy. low-cost auto insurance. Automobile insurance coverage normally contain a number of sort of insurance coverages. Because insurance policy legislations differ from one state to another, the complying with info is right here to give you a broad overview of regular insurance coverages, and it isn't a statement of agreement.